3rd pension pillar

Private voluntary pension scheme

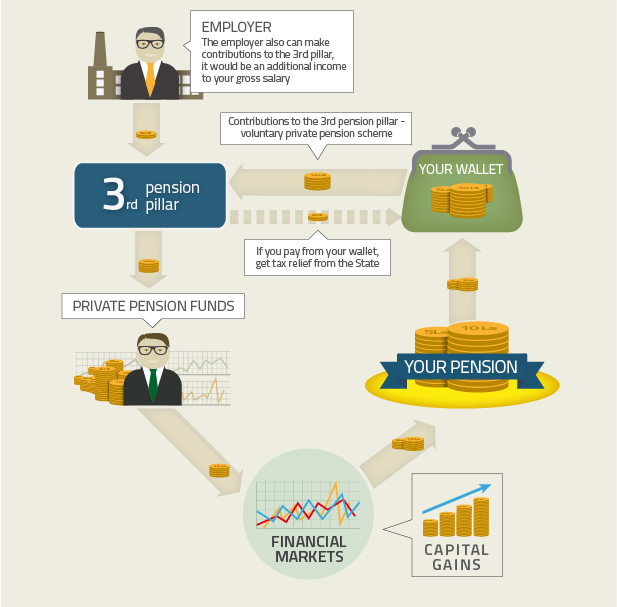

3rd pension pillar is the possibility according to free choice to create additional savings for your pension. It means that additionaly to the 1st and the 2nd pension pillar, part of your income is invested in private pension funds by you personally or by your employer.

It is an opportunity to take care of your old age, making regular contributions over a long period. Over time, the expected savings will serve you as an addition to the state guaranteed pension.

Voluntary private pension scheme or the 3rd pension pillar was launched in July, 1998, and it gives you the opportunity to create additional voluntary savings in addition to the state guaranteed 1st and the 2nd pension pillar, amount of money that you and/or your employer regularly pay into the pension fund is invested in different securities, and depending on the chosen investment strategy, the general situation in the financial markets and the fund manager performance, provides adequate return on investment.

There are two types of private pension funds: closed, for fund founders` (corporate) staff, and open, of which any individual may become a participant, either directly or through an employer.

The law foresees that the rights to establish private funds have the Latvian commercial banks that have the right to accept deposits from individuals, insurance companies and they are entitled to provide life insurance, as well as legal persons. The contributed money private pension funds invest with the aim not only to maintain but also increase the value of savings over a long time period.

Good to know!

- You have the right to obtain a complete overview of its financial performance.

- If you are not satisfied with the selected pension fund operations, you have the right to transfer the accumulated pension capital to another pension fund;

- When the employer contributes to a private pension fund in your favor, he has the right to all the social and income tax refunds laid down in the law.

- If contributions to a private pension fund you make by yourself, then you are entitled to receive income tax refunds laid down in the law by submitting the annual income declaration to the State Revenue Service after the end of the year, which reflects the sums paid into the pension fund over the year.